Family Office Foundation

Unite your family members in passing on your values to the next generation,

moving from success to significance, and leaving a meaningful legacy

moving from success to significance, and leaving a meaningful legacy

CLIENT SUITABILITY

Every family passing along wealth or control over assets to the next generation should have annual family meetings to review success. Clients with more than $1,000,000 of assets passing to charities or family members often need to review a variety of legal, tax, and investment issues. Professional help is often needed when communicating goals for transferring wealth to heirs or philanthropic causes. Communication is often most effective in family meetings that affirm family relationships and illustrate how discussions of technical planning details foster deeper relationships. Ideally, each family meeting should be led by an adviser who understands the family's relational dynamics as well as the technical issues related to transferring ownership, cash flow, control or management responsibility to the next generation.Expected Outcomes:

- Develop a strong sense of family unity

- Inspire each family member to pursue a calling

- Establish clear leadership and succession structures

- Help family members understand their responsibilities and likely rewards related to upholding the family's values

- Clarify how and when families should fund charities while maintaining permissible access to income from assets given to charity.

Steps for Conducting a Family Meeting

Please call 1-800-447-7090 to Schedule a Family Meeting with Tim Voorhees and/or Wealth Counselors on his team

- Affirm Revelation and Document Resources

- Clarify how the family will give honor to the ways in which God’s revelation has contributed to its success

- Have professionals document financial and non-financial resources that help the family build wealth

- Uphold Vision and Values

Successful families affirm core values and inspire family members to stand strong while holding to a transcendent vision. - Establish Leadership Structures

- Choose a leader who can foster effective discussions about the family’s vision and core values

- Keep the agenda simple

- Agree on the duration of the meeting

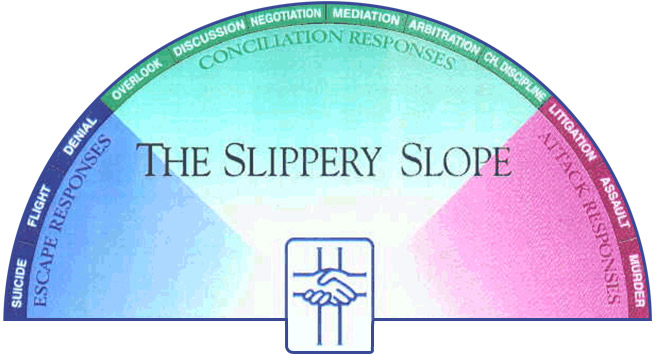

- Establish Peacemaking Principles

Most families will agree that relationships matter more than money, power, or other idols. Family leaders will also generally agree that they want God’s light to shine into the wealth planning process. Nonetheless, the family meeting process can often expose areas of darkness. When this happens, peace-fakers will minimize their concerns, peace-breakers will engage in defensive behaviors, and peacemakers will attempt to encourage God-honoring solutions, like those from www.Peacemaker.net.

- Clarify Benefits for Beneficiaries

Agree in advance on which flow charts, cash flow projections and inheritance amounts should be shared with children, in-laws, and advisers. - Prepare for Future Meetings

- Establishing Timing and Frequency

If the family is gathering for a wedding or funeral, see about scheduling some type of meeting. During a first meeting, agree on the frequency for subsequent meetings. - Managing Next Actions

A skilled wealth counselor can identify unique ways to encourage the emotional and financial well-being of each family member. The wealth counselor can then track fulfillment of next actions using a project management that keeps decision-makers focused on the most important issues. - Choosing the Location(s) for Future Meetings

Destination resorts often help accommodate diverse types of family members. If not all family members can go to the resort (or cruise ship), some family members can join virtually (using GoToMeeting.com) or similar secure video technologies.

- Establishing Timing and Frequency

- Anticipate and Encourage Questions

Heirs want to know when they will receive ownership and control. There are very often many unspoken questions about the wealth management and transfer processes. A skilled meeting facilitator should know how to handle these questions.